Liability Only Auto Insurance

25+ Years of Trusted Service *

Call us 1-855-620-9443

25+ Years of Trusted Service *

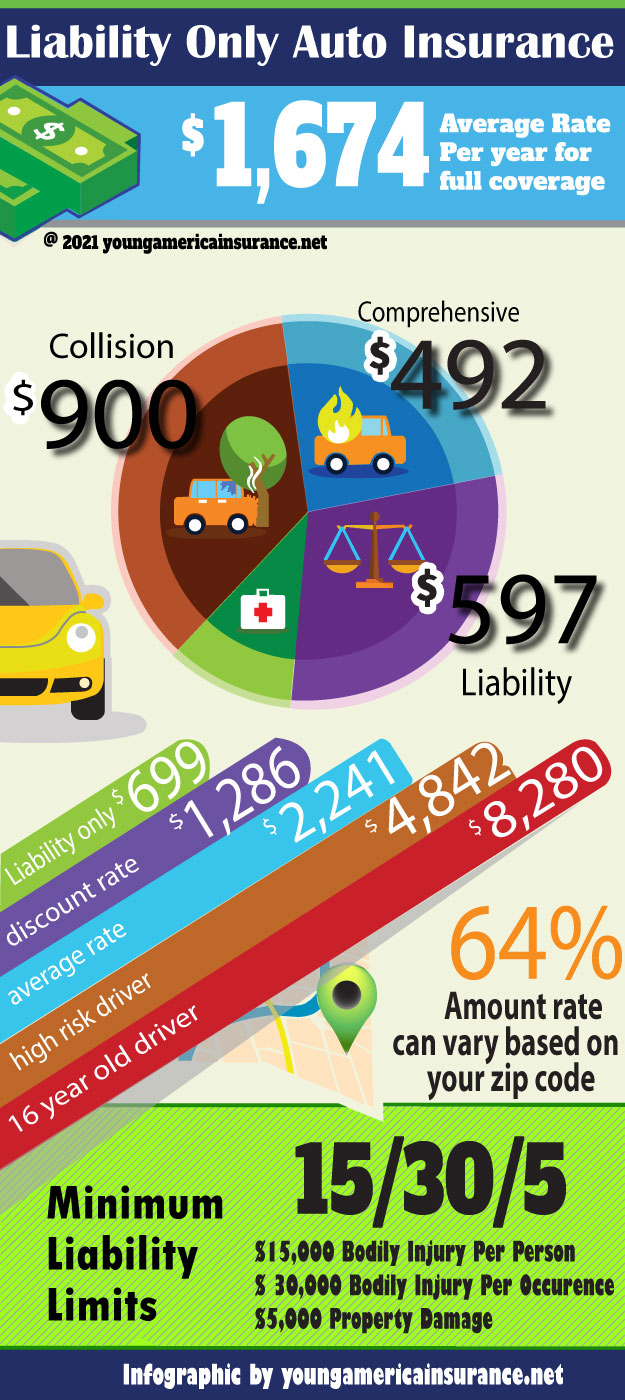

If your vehicle is more than ten years old and you don’t drive it much, you might consider buying liability-only auto insurance. Liability insurance is the cheapest type of coverage you can get. For qualified drivers, rates can be as low as $35 dollars per month. There are also select providers in certain states that offer liability coverage with no deposit required. Check the best rates now by entering your zip code.

Do you own a second vehicle that is only driven a few times a month? Or are you a student that only drives a few miles a week and doesn’t need expensive coverage? Or perhaps you’re a retired person who wants to reduce their car insurance costs by getting cheap car insurance with a low down payment and just doesn’t know how to. These are all situations in which liability-only automobile insurance might make sense. Think about it. Why pay for comprehensive insurance on an older vehicle if you drive less than 100 miles per week?

Liability policies are much cheaper than collision and comprehensive insurance, but they offer less coverage, which you need to consider before buying a policy. For example, if you get into a severe accident that you are responsible for, a liability policy might not pay for the medical and property damages. You could end up in court with an expensive judgment and have to make payments for years, all because you had limited coverage. If you choose liability auto insurance, it’s wise to get higher limits to have more financial protection.

Are you interested in saving the most money on your auto insurance? If you answered yes to some of these questions, then you might take a close look into a liability-only auto insurance policy. While the coverage is limited, it can save you hundreds per year over full coverage policies. Many motorists with a good driving record can get covered for under $50 a month. Most comprehensive policies cost over $110 a month, so you can potentially save over $700 per year.

If you operate a motorized vehicle in the U.S., you are going to need liability insurance. There is only one state, New Hampshire, that does not require residents to maintain coverage to drive. Even if you live in New Hampshire, carrying auto insurance is a wise decision that could save you money in the long run.

Each state sets its insurance laws, including limit requirements. Before you buy a policy, you should take a few minutes and study the auto insurance laws where you live.

Liability car insurance is designed to pay out, up, and to the policy limits when you are ruled at fault in an accident.

You will be covered for the following:

If you hit another vehicle and are ruled to be at fault, liability coverage will pay for the driver and or passengers’ medical costs. The amount covered will depend on the limits you choose. With medical care increasing each year, it’s wise to get a high-limit policy to be adequately insured. With medical care increasing each year, it’s smart to get a high-limit policy to be adequately insured. State minimum coverage will often not cover bodily injuries in severe vehicular accidents.

If you were ruled at fault while causing an accident with another party’s property, liability insurance will pay for the damages that occurred up and to the policy limits. This usually is the vehicle you damaged in an incident you caused. For example, you backed into a vehicle in a parking lot and caused $2,000 in automobile body damage that you would then be liable for.

The payout your insurance company pays for a liability automobile insurance claim is dependent on the coverage limits you select. Each state in the U.S. has insurance departments that create guidelines for consumers purchasing coverage.

You must buy the minimum amount of liability auto insurance in the state you live in but are free to purchase additional amounts. Remember, auto insurance is there to protect you financially. If you have $150,000 in assets, then try to buy coverage limits for $150,000 or even higher.

| State | Min Bodily Injury Per Person | Min Bodily Injury Per Accident | Min Property Damage Per Accident |

|---|---|---|---|

| Alabama | 25k | 50k | 25k |

| Alaska | 50k | 100k | 25k |

| Arizona | 25k | 50k | 15k |

| Arkansas | 25k | 50k | 25k |

| California | 15k | 30k | 5k |

| Colorado | 25k | 50k | 15k |

| Connecticut | 20k | 50k | 25k |

| Delaware | 25k | 50k | 10k |

| District of Columbia | 25k | 50k | 10k |

| Florida | N/A | N/A | 10k |

| Georgia | 25k | 50k | 25k |

| Hawaii | 20k | 40k | 10k |

| Idaho | 20k | 50k | 15k |

| Illinois | 25k | 50k | 20k |

| Indiana | 25k | 50k | 10k |

| Iowa | 20k | 40k | 15k |

| Kansas | 25k | 50k | 10k |

| Kentucky | 25k | 50k | 10k |

| Louisiana | 15k | 30k | 25k |

| Maine | 50k | 100k | 25k |

| Maryland | 30k | 60k | 15k |

| Massachusetts | 20k | 40k | 5k |

| Michigan | 20k | 40k | 10k |

| Minnesota | 30k | 60k | 10k |

| Mississippi | 25k | 50k | 25k |

| Missouri | 25k | 50k | 10k |

| Montana | 25k | 50k | 10k |

| Nebraska | 25k | 50k | 25k |

| Nevada | 25k | 50k | 20k |

| New Hampshire* | 25k | 50k | 25k |

| New Jersey | 15k | 30k | 5k |

| New Mexico | 25k | 50k | 10k |

| New York | 25k | 50k | 10k |

| North Carolina | 30k | 60k | 25k |

| North Dakota | 25k | 50k | 25k |

| Ohio | 25k | 50k | 25k |

| Oklahoma | 25k | 50k | 25k |

| Oregon | 25k | 50k | 20k |

| Pennsylvania | 15k | 30k | 5k |

| Rhode Island | 25k | 50k | 25k |

| South Carolina | 25k | 50k | 25k |

| South Dakota | 25k | 50k | 25k |

| Tennessee | 25k | 50k | 15k |

| Texas | 30k | 60k | 25k |

| Utah | 25k | 65k | 15k |

| Vermont | 25k | 50k | 10k |

| Virginia** | 25k | 50k | 20k |

| Washington | 25k | 50k | 10k |

| West Virginia | 25k | 50k | 25k |

| Wisconsin | 25k | 50k | 10k |

| Wyoming | 25k | 50k | 20k |

When you buy a policy, there will be two liability limit types. These are:

When you choose your liability insurance limit, this is the max amount the auto ins carrier pays to replace or repair the damage you caused. You can increase coverage by raising the limit.

These coverage amounts will cap the amount paid for each person you caused injury to, and the total amount per accident. This amount is essential, as medical costs are rising. If you hit a car full of passengers, there is a good chance your cap will be exceeded, at which point you may get sued for the remaining balance.

You might be tempted to go for the cheapest liability auto insurance with a low state minimum insurance policy. This low coverage should be reserved for those who have a car in storage that is hardly ever used or are in extreme financial hardship.

With healthcare costs exploding over the past 20-plus years, you need to consider protecting yourself from a severe at-fault accident. This means buying the highest limited amount you can afford. A good starting point is $100,000 in liability coverage. That amount will often exceed state minimums but protect you from most accident claims if you cause an accident.

While some liability policies from $19 per month can be tempting, you probably need more protection. You can purchase a $100,000 liability-only insurance policy from online providers like Young America Insurance for only $39 per month. It will give you better coverage while still keeping your insurance costs down.

Thanks to instant information online, anyone can find great rates on liability-only car insurance in a fraction of the time it used to take calling up several agents. With sites like Young America auto insurance, you can compare dozens of insurer quotes direct, all from your smartphone or laptop.

Many people can save $500 or more comparison shopping direct auto insurance rates. Young America Insurance provides quotes from both top national providers as well as regional insurers. This helps you find the cheapest rate for the coverage you need.

Buying online gives you total control over the buying process. It allows you to build a policy that fits your budget while still giving you great coverage. Start your online quote now and get rates as low as $29 a month. The entire quote process only takes about 5 minutes.

Buying cheap liability-only car insurance can be done in under 20 minutes or less. All you need to do is apply for your direct quote and get going. Enter your zip code to get started and get your cheapest rate.