No Down Payment Car Insurance

25+ Years of Trusted Service *

Call us 1-855-620-9443

25+ Years of Trusted Service *

Are you in need of no down payment car insurance with cheap monthly rates? As long as you meet certain qualifications, insurance providers will agree to cover you with no money down. On the other hand, if you have a history of speeding tickets, there is a good chance that some companies will consider you a high-risk driver. This means your chances of paying nothing the first month of coverage will be limited.

Although not every state allows you to purchase car insurance with no deposit, many do. They include California, Arizona, Florida, Georgia, New York, Oklahoma, and Washington. California has more companies offering 0 down auto insurance than any other state in the country. Californians should have no problem finding an insurer that offers these plans, coupled with cheap monthly rates.

If you do not live in one of these states, don’t worry. Some carriers will help you get insured for as little as $20 down. This is less than a tank of gasoline. The best way to find these deals is to shop around. Input your zip code today and comparing online rates and plans.

Multiple nationally known insurance companies allow you the chance to get no down payment car insurance. They include Allstate, Geico, Kemper, Progressive, Safe Auto, and State Farm. Some of these providers, like Progressive Insurance, allow you to buy a policy online for zero down. This means you can get covered in less than 30 minutes with the first month free. You can even use your smartphone to purchase the policy. This saves consumers not only money but lots of time.

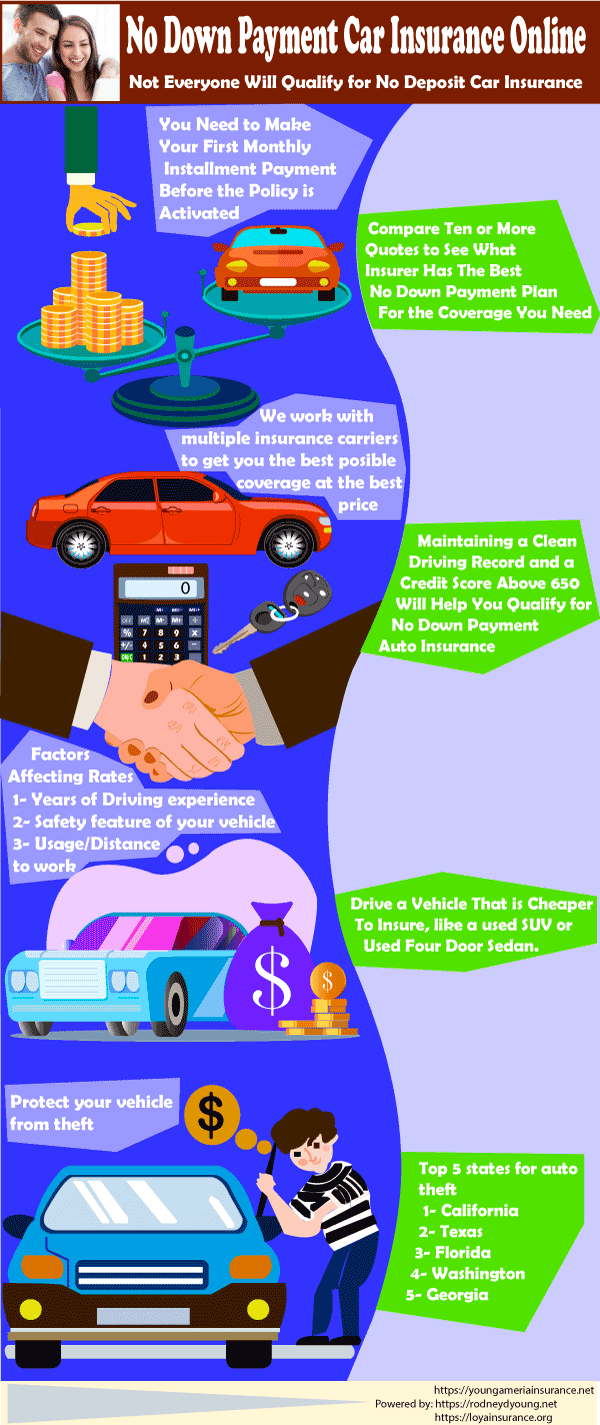

Keep in mind; several factors may affect your ability to get insured with no money upfront. This includes your age, driving record, and credit score. If you have bad credit, below 600, it may be difficult to find coverage with zero down. You might need to pay an up-front amount of $50 or more and higher monthly rates.

In addition to jeopardizing your chances of getting the car insurance first month free no deposit, speeding tickets are also likely to make your premium go up. To learn exactly how much, you’ll want to contact your local agent or broker. They have access to multiple providers and have a wealth of experience. You’ll also want to compare quotes from both direct insurers like Geico and Esurance, as well as national carriers. This includes companies like Farmers, Nationwide, Amica, and State Farm Insurance Company.

Your credit score also impacts your ability to get a no down payment car insurance, as does the type of car you drive. For example, if you own a newer, faster car, potential insurers may consider you a higher risk motorist. This also applies to you if you are required to file an SR-22 with your state DMV. Fortunately, if you have an impeccable driving record and a good credit score above 650, getting cheap coverage should be a quick and painless process.

Do you renew your same old policy as many other people do, even when it keeps going up? If you’re thinking about switching to a new insurance company, there are several things you need to consider. First, you should compare multiple rates to try and save 10% or more before switching.

Often times, insurers will give long-term customers a lower rate the longer they’ve been a customer. You might have to check out at least 10 quotes before finding a trusted company that will save you more money. You can also contact your current provider and allow them to match the competitor’s rate. If you’ve been a good customer, they might just match or lower the competing rate. If not, you can switch to a cheaper company that offers the first month of free coverage.

Most companies offer a variety of payment plans to choose from. Many allow you to choose from one-time payment, as well as 3-months, 6-months, 12-months, and even 18-month payment plans. Planned payments that are deducted monthly or quarterly may also be an option. Making monthly payments has several advantages, including the fact that you won’t have to come up with a significant amount of cash at one time.

Most drivers who choose to make monthly insurance payments do so because their budget is tight, and they simply do not have the means to throw down a large lump sum. If you are considering a company and they don’t have an installment plan that suits your needs, take the time to speak to an agent. They may be able to get you exactly what you are looking for. If not, go online and find a direct provider that offers cheap installment plans.

Remember, car insurance companies take on plenty of risks when offering no down payment car insurance policies. As a result, they’ll want to recuperate as much as they possibly can with your first payment. Some insurers, in a very polite way, will make you pay the premium upfront. To encourage this, they will often offer a discount for one-time payments and eliminate any fees associated with a payment plan. It is a very cheap car insurance no deposit deal, which ends up saving you 5 percent or more on auto insurance. If you have the savings, it makes sense.

There are indeed going to be times in your life when finding the extra cash needed to make your car insurance payment is tough. In just about every state, though, it’s illegal to operate a vehicle without it. However, it’s necessary for every driver because accidents do happen, and most are very expensive. Not only will the car insurance protect you, but it can also protect the passengers in your own car, along with those in the other vehicle.

Tips for Buying the Cheapest Auto Insurance with No Down Payment

Think a little bit, and you will find many ways to get cheaper coverage. They include:

Whether you qualify for no down payment car insurance or not, you can still find great deals online. Some direct providers will get you insured for the first month with an initial payment of only $20. Almost anyone can afford that. To find the best deals and rates, start comparing quotes. Enter your zip code and check rates from multiple companies in less than 5 minutes.