Switch Car Insurance Companies

25+ Years of Trusted Service *

Call us 1-855-620-9443

25+ Years of Trusted Service *

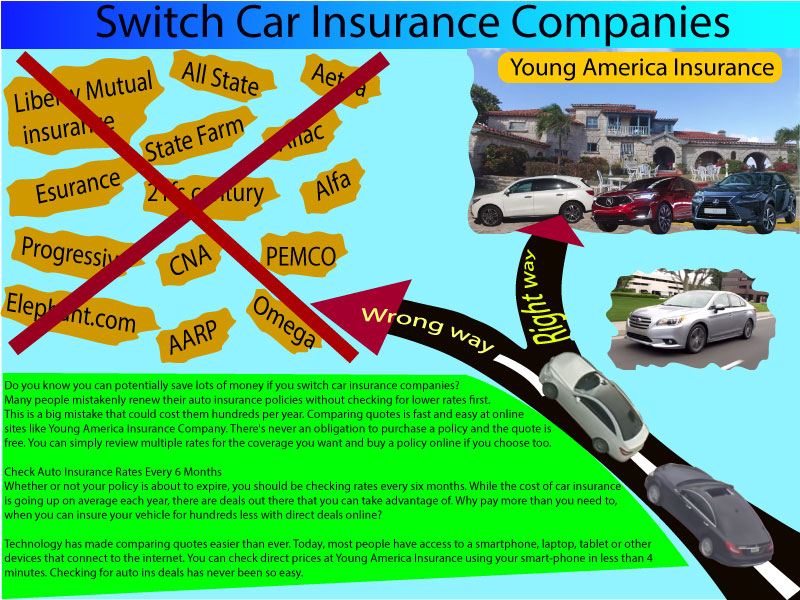

Do you know you can potentially save lots of money if you switch car insurance companies? Many people mistakenly renew their auto insurance policies without checking for lower rates first. This is a big mistake that could cost them hundreds per year. Comparing quotes is fast and easy at online sites like Young America Insurance Company. There’s never an obligation to purchase a policy and the quote is free. You can simply review multiple rates for the coverage you want and buy a policy online if you choose too.

Whether or not your policy is about to expire, you should be checking rates every six months. While the cost of car insurance is going up on average each year, there are deals out there that you can take advantage of. Why pay more than you need to, when you can insure your vehicle for hundreds less with direct deals online?

Technology has made comparing quotes easier than ever. Today, most people have access to a smartphone, laptop, tablet or other devices that connect to the internet. You can check direct prices at Young America Insurance using your smart-phone in less than 4 minutes. Checking for auto insurance deals has never been so easy.

If you are thinking of switching auto insurance companies, make sure you maintain coverage until your new policy is in effect. You do not want any lapse because you will end up paying more the next time you apply for auto insurance. Once you have bought a new plan and received your documentation, you can cancel your old policy.

If you pay your premium using an automatic payment program, make sure you get verification from the carrier that is has been cancelled. As an extra precaution, you can call your bank or credit card provider and inform them that you have cancelled the auto-pay for the insurer.

If you feel like you are paying too much for your current insurance plan, then it might be a good time to change providers. Before you do so, make sure your current coverage protects you adequately. All insurance and especially auto should provide the limits that cover you in the event you get into a serious accident. With medical costs escalating each year, you need all the protection you can afford.

One simple trick to getting higher limits and better coverage is to raise your deductible. This will lower the cost of your premiums, while allowing you to buy a better policy, like collision and comprehensive. If you can afford it, purchase $100,000 per individual person and $300,000 in accident liability insurance. This will give you better protection than state minimum policies, which often fall short of covering most vehicular accidents.

Once you know the coverage you need, it’s time to shop and get your premiums lowered as much as you can. The best place to find great deals is online. Insurers know most people start their auto insurance shopping on the web. There is a fierce battle for your insurance dollars. Rates are often lower online thanks to direct web pricing.

Carriers offer better deals online because they don’t have to pay agents hefty commissions. Most shoppers that buy direct policies can save $500 or more. You need to compare multiple rates to find the best deals available. Direct to consumer sites like Young America Auto Insurance help you do just that. You can comparison shop 10 quotes in only about four minutes.

Most carriers offer several discounts you can apply for. This includes:

Safe Driver

Military and Veteran

Anti-Theft and Safety Devices (Airbags and anti-lock braking systems)

Full Premium Payment Upfront – typically a 2% discount

Good Student Discount (A or B GPA)

Bundling Multiple Cars and Home and Auto Policies together

Low Mileage Discount (usually less than 1,000 miles driven per month)

Garaged Parked

Auto Bill Pay

Senior Citizen and AARP

Teacher Discounts

Now you know how easy it is to switch car insurance companies. Apply for your free web quote and see how much you can save by changing insurers.