Very Cheap Liability Car Insurance in Las Vegas (2026): Nevada Minimum Limits, Real Cost Benchmarks, and How to Save

Young Americans Insurance Editorial Team

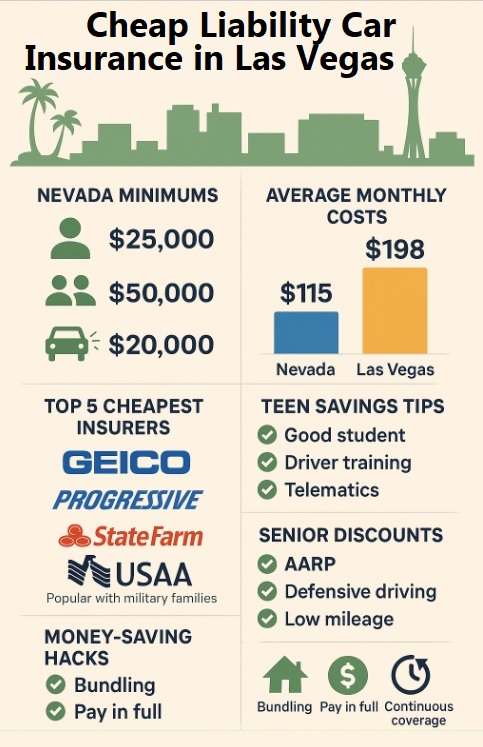

Updated for 2026: Nevada minimum limits, Las Vegas price benchmarks, and practical ways to reduce liability premiums.

Educational content only. Your rate depends on ZIP code, driving record, vehicle, and selected coverages.

- Nevada minimum liability: 25/50/20 (required statewide).

- Las Vegas average “all-in” cost: about $4,511/year for car insurance (many drivers pay less with shopping, but Vegas skews high).

- Nevada minimum coverage benchmark: about $80–$90/month statewide; Las Vegas often runs higher than smaller NV cities.

Las Vegas is one of the most expensive places in Nevada to insure a car, largely due to heavy traffic, frequent claims, and theft risk.

Recent estimates put the average Las Vegas car insurance cost around $4,511 per year (about $376 per month).

The good news: if you’re mainly trying to stay legal, liability-only (minimum) coverage is typically much cheaper than full coverage.

This guide explains Nevada’s required limits, why rates run high in Las Vegas, which insurers are commonly competitive for liability-only coverage, and how to lower your premium without risking DMV penalties from a coverage lapse.

Nevada’s Minimum Liability Laws

Nevada requires all drivers to carry liability insurance with at least the following 25/50/20 minimums:

- $25,000 for bodily injury (or death) per person

- $50,000 for bodily injury (or death) per accident

- $20,000 for property damage per accident

Liability insurance pays for injuries or property damage you cause to others in an accident. It does not cover your own car repairs or your own medical bills if you’re at fault.

Nevada verifies insurance electronically through the DMV, and even a short lapse can trigger fees and penalties.

If your car is registered, keep coverage continuous (or follow DMV rules for taking a vehicle off the road).

If you recently had a gap, see how to get car insurance after a lapse.

Why Las Vegas Car Insurance Costs More

Several factors tend to raise liability prices in Las Vegas:

- Higher accident frequency — busy freeways, nightlife traffic, and tourists increase crash exposure.

- Theft and vandalism risk — higher claim activity in some ZIP codes.

- Claim severity — repairs and medical costs can be expensive, raising payouts.

- Urban density — more vehicles per mile means more chances of a claim.

Statewide, minimum coverage is commonly estimated around $80–$90/month.

In Las Vegas, many drivers see higher quotes—especially with tickets, a prior lapse, or higher-risk vehicles.

Factors Driving Las Vegas Insurance Costs

Insurers don’t publish an official “percentage breakdown” of pricing factors, but these are the most common cost drivers in Las Vegas.

(Use this as a practical checklist when you’re trying to lower your rate.)

| Cost Driver | Why it matters |

|---|---|

| Accident frequency | More crashes → more claims → higher premiums |

| Theft/vandalism | Higher losses in some ZIP codes raise pricing |

| Driver record | Tickets/accidents can increase rates at renewal |

| Coverage lapses | Even short gaps can trigger higher quotes and DMV issues |

| Vehicle & usage | High repair costs or high mileage can increase risk |

Top 10 Cheapest Liability Car Insurance Companies in Las Vegas

“Cheapest” depends on your profile and ZIP code, but these companies are commonly competitive for

liability-only coverage in Las Vegas.

Always quote at least 3–5 carriers with the same limits.

- GEICO — often strong base rates for clean-record drivers; easy online management.

- Progressive — can be competitive across many profiles; telematics may help safe drivers.

- State Farm — good bundling potential; agent support for drivers who prefer in-person help.

- Allstate — discount opportunities (multi-policy, safe driver) depending on profile.

- Farmers — may price well for certain stable profiles; agent guidance available.

- Liberty Mutual — discounts may improve pricing for families/multi-car households.

- Nationwide — bundling can help; some drivers benefit from usage-based options.

- USAA — often excellent rates if eligible (military families).

- Dairyland — non-standard option; can help drivers needing SR-22 or after a lapse.

- AAA Nevada — membership-based pricing; roadside perks may add value.

Liability Insurance for Teen Drivers in Las Vegas

Teens are expensive to insure because insurers see higher claim risk for new drivers. To keep liability costs down:

- Good student discount — many carriers reduce rates with a B average (or equivalent proof).

- Driver training — completion certificates may help.

- Telematics — safe driving habits can reduce premiums over time.

- Family policy — usually cheaper than a separate teen policy.

- Pick the right car — modest vehicles with strong safety ratings are often cheaper to insure.

Liability Insurance for Seniors in Las Vegas

Many seniors have strong driving history, but rates can rise later in life. Ways seniors can often save:

- Defensive driving refreshers — some insurers offer discounts for approved courses.

- Low-mileage discounts — if you drive less in retirement, ask about mileage-based savings.

- Shop renewals — pricing shifts; re-quote every 6–12 months.

- Consider higher limits — minimum limits may not protect savings/assets in a serious claim.

How to Save Money on Liability Insurance in Las Vegas

These steps tend to create the biggest savings without cutting corners on legality:

- Compare 3–5 quotes on the same day using identical limits and driver info.

- Bundle policies (auto + renters/home) if it lowers your total cost.

- Use telematics if you drive safely and can avoid hard braking/speeding.

- Pay in full to reduce installment fees (when possible).

- Keep continuous coverage — even a one-day lapse can cost you more.

- Ask about affinity discounts (military, employer groups, memberships).

- If you have more than liability consider higher deductibles on optional coverages (not liability) to lower premium.

Common Pitfalls to Avoid

- Letting coverage lapse and triggering DMV penalties and higher renewal pricing.

- Buying the bare minimum without thinking — a serious crash can exceed 25/50/20 quickly.

- Ignoring SR-22 needs if you have a DUI/major violation or certain lapse situations.

- Falling for “cheap” monthly plans with added fees that raise the 6-month total.

FAQs About Liability-Only Auto Insurance in Las Vegas

What is the minimum liability coverage required in Las Vegas?

Nevada requires 25/50/20 liability coverage statewide.

Can I drive without liability insurance if I barely use my car?

If the car is registered, it generally must be insured (or handled under DMV rules for taking a vehicle off the road).

Which company is usually cheapest for liability in Las Vegas?

It depends on your profile, but GEICO and Progressive are often competitive, and USAA is frequently best if eligible.

Do teens need their own policy?

Usually no—adding them to a parent’s policy is typically cheaper than a separate policy.

Are seniors penalized heavily for liability insurance?

Not always. Discounts and lower mileage can help, but re-shopping regularly is important.

The Final Word on Cheap Liability Car Insurance in Las Vegas

Very cheap liability car insurance in Las Vegas is possible, but it takes strategy: pick the right limits, compare multiple insurers, keep continuous coverage, and use discounts that match how you actually drive.

For many drivers, GEICO, Progressive, State Farm, and (if eligible) USAA are strong starting points for competitive liability pricing.

Find very cheap liability car insurance in Las Vegas today by comparing custom online quotes.

Once you find a policy that meets Nevada’s minimums and fits your budget, you can often purchase and manage it online.

Benchmarks referenced: Las Vegas average cost estimate (NerdWallet, Feb 2026). Nevada minimum-limit requirement (Nevada DMV). Nevada statewide average minimum coverage benchmarks (MoneyGeek/Bankrate recent updates).