Cheap Liability Car Insurance in New York: 2026 Cost Benchmarks, Minimum Limits, and How to Save

Young Americans Insurance Editorial Team

Updated for 2026: NY minimum limits + price benchmarks, plus practical ways to save.

Educational content — compare quotes for your exact rate.

- NY minimum liability: 25/50/10 (plus required PIP and UM).

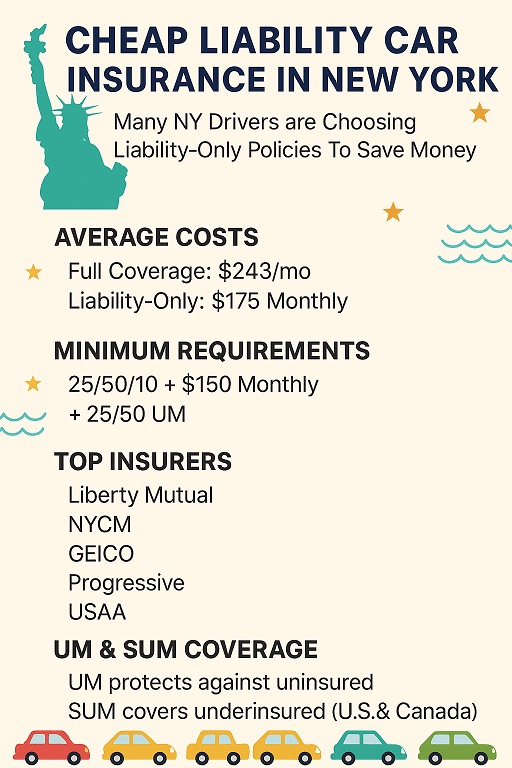

- 2026 benchmark: minimum coverage averages about $148/month statewide; full coverage averages about $341/month (benchmarks vary by city/ZIP and driver profile).

- Big warning: “Cheap” can backfire if limits are too low—consider higher limits if you have income or assets to protect.

New York’s auto insurance market is consistently among the most expensive in the U.S., largely because of dense traffic, higher claim costs, and mandatory no-fault benefits.

Recent statewide benchmarks put full coverage auto insurance around $341 per month (about $4,092 per year),

while state-minimum coverage averages about $148 per month (about $1,773 per year).

Because prices are high, many drivers look at liability-only auto insurance to stay legal while keeping payments manageable.

The key is doing it safely: meet New York’s rules, avoid coverage lapses, and shop smart so you don’t overpay for the same limits.

New York’s Minimum Liability Laws

Drivers in New York must carry at least the following minimum liability coverage (often shown as 25/50/10):

- $25,000 bodily injury per person

- $50,000 bodily injury per accident

- $10,000 property damage

New York also requires:

- $50,000 Personal Injury Protection (PIP) under the no-fault system

- $25,000/$50,000 uninsured motorist bodily injury (UM) limits

Liability pays for injuries/property damage you cause to others—not your own car repairs or your own injuries.

Driving uninsured (or letting your policy lapse) can trigger fines, registration suspension/revocation, license issues, and reinstatement fees.

New York’s DMV tracks insurance electronically, so even short lapses can create penalties.

Why New York Insurance Costs More

New York often runs expensive for a few practical reasons:

- Heavy traffic and higher crash exposure, especially in NYC/Long Island.

- No-fault system with mandatory PIP benefits on every policy.

- Higher repair and medical costs compared to many states.

- Theft/vandalism risk in certain areas.

- Claims/legal costs that can be higher in dense metro markets.

In practice, a driver in Manhattan or Brooklyn can pay far more than a driver in upstate regions.

If you’re trying to cut costs, focus on the variables you can control—continuous coverage, clean driving, discount eligibility, and comparing quotes.

Top Liability Car Insurance Companies in New York

These insurers are commonly competitive for liability-focused shoppers in New York (but the “cheapest” varies by ZIP code and driver profile):

- GEICO – Often competitive in many NY regions; strong online tools.

- Progressive – Competitive for a wide range of drivers; telematics options.

- Liberty Mutual – Can price well depending on profile and discounts.

- NYCM (New York Central Mutual) – Often stronger in upstate markets.

- State Farm – Large agent network; bundling can help.

- Allstate – Discount opportunities for safe drivers and multi-policy households.

- Erie Insurance – Competitive in some upstate areas (where available).

- Nationwide – Telematics + multi-policy discounts.

- USAA – Often excellent pricing if eligible (military families).

Not every company is cheapest everywhere. A smart approach is to get at least 3–5 quotes for the exact same limits and drivers, then re-shop at renewal.

Liability Insurance for Teen Drivers in New York

Adding a teen can raise premiums sharply. To keep costs under control:

- Ask about good student discounts (often tied to grades or school documentation).

- Complete approved driver education/safety courses where applicable.

- Consider safe-driver/telematics programs if they fit your household.

- Add the teen to a family policy (usually cheaper than a separate policy).

- Choose a modest, safe vehicle with lower repair costs.

If you need broader protection for a new or financed car, see

full coverage options for higher-risk drivers.

Liability Insurance for Seniors in New York

Rates can rise later in life, but many seniors still qualify for savings:

- Ask about defensive driving refresher discounts (where offered/recognized).

- Use low-mileage discounts if you drive less in retirement.

- Bundle auto with renters/homeowners when it truly saves money.

- Re-shop every renewal—pricing changes often by carrier.

- Consider higher liability limits if you have assets to protect.

How to Save Money on Liability Insurance in New York

These strategies are realistic and generally safe for most drivers:

- Compare 3–5 quotes on the same day (same limits, same drivers, same address).

- Bundle auto with renters/homeowners if it truly reduces the total cost.

- Use safe-driver programs (telematics) only if your driving habits will likely score well.

- Pay in full when possible to reduce installment fees.

- Avoid lapses—coverage gaps can raise renewal costs fast.

- Ask about affiliation discounts (employer, alumni, professional groups, military, etc.).

- If you carry more than liability, raising deductibles can lower the price of optional coverages (not liability itself).

Uninsured Motorist (UM) and Supplementary UM/SUM in New York

New York includes Uninsured Motorist (UM) bodily injury coverage on auto policies.

UM helps pay for injuries to you and your passengers if you’re hit by an uninsured driver or a hit-and-run driver (bodily injury only—vehicle damage is separate).

New York’s basic UM minimum limits are:

- $25,000 per person

- $50,000 per accident

Supplementary UM/UIM (often called SUM) is optional extra protection that can help when the at-fault driver has insurance,

but not enough to cover your injuries. In New York, insurers must offer SUM up to the amount of your own bodily injury liability limits.

SUM generally applies across the U.S. and Canada (policy details matter—check your declarations page).

If you can afford it, matching your SUM limits to your liability limits is often one of the best “value” upgrades for injury protection—especially in a high-cost state.

Common Pitfalls to Avoid

- Letting coverage lapse (even briefly) and triggering DMV penalties and higher renewal pricing.

- Choosing minimum limits without considering your financial exposure in a serious crash.

- Focusing only on the monthly payment and missing fees, down payments, or plan restrictions.

- Assuming NYC pricing = upstate pricing (location is a major driver of cost).

FAQs About Liability-Only Auto Insurance in New York

What is the required liability coverage in New York?

New York requires 25/50/10 liability, plus $50,000 PIP and 25/50 uninsured motorist bodily injury coverage.

Can I register a car in New York without insurance?

No. You need New York State-issued insurance to register and keep a vehicle registered.

Which insurer is usually cheapest for liability in New York?

It varies by region and driver profile. GEICO, Progressive, Liberty Mutual, and NYCM are commonly competitive, and USAA can be excellent if eligible.

Do teens need their own policy in New York?

Usually no—adding a teen to a family policy is typically cheaper than a separate policy.

Do seniors pay much more for liability insurance in New York?

Rates can rise with age, but defensive driving, low-mileage status, and shopping around can still create meaningful savings.

The Final Word on Cheap Liability Car Insurance in New York

Cheap liability car insurance in New York is possible, but it takes strategy.

Start by meeting the required 25/50/10 liability limits (plus PIP and UM), then compare 3–5 quotes with the same limits.

Keep continuous coverage, use discounts that truly fit your situation, and consider higher limits (and SUM) if you’d struggle financially after a serious crash.

It’s time to start saving!

Compare quotes from top insurers — enter your ZIP code and find liability coverage that fits New York’s rules and your budget.

Pricing benchmarks referenced on this update are commonly reported by major insurance rate analysts (e.g., Bankrate’s NY cost analysis for 2026).

Legal requirements align with New York DMV/DFS consumer checklists for minimum required coverages.