$20 Down Payment Car Insurance

25+ Years of Trusted Service *

Call us 1-855-620-9443

25+ Years of Trusted Service *

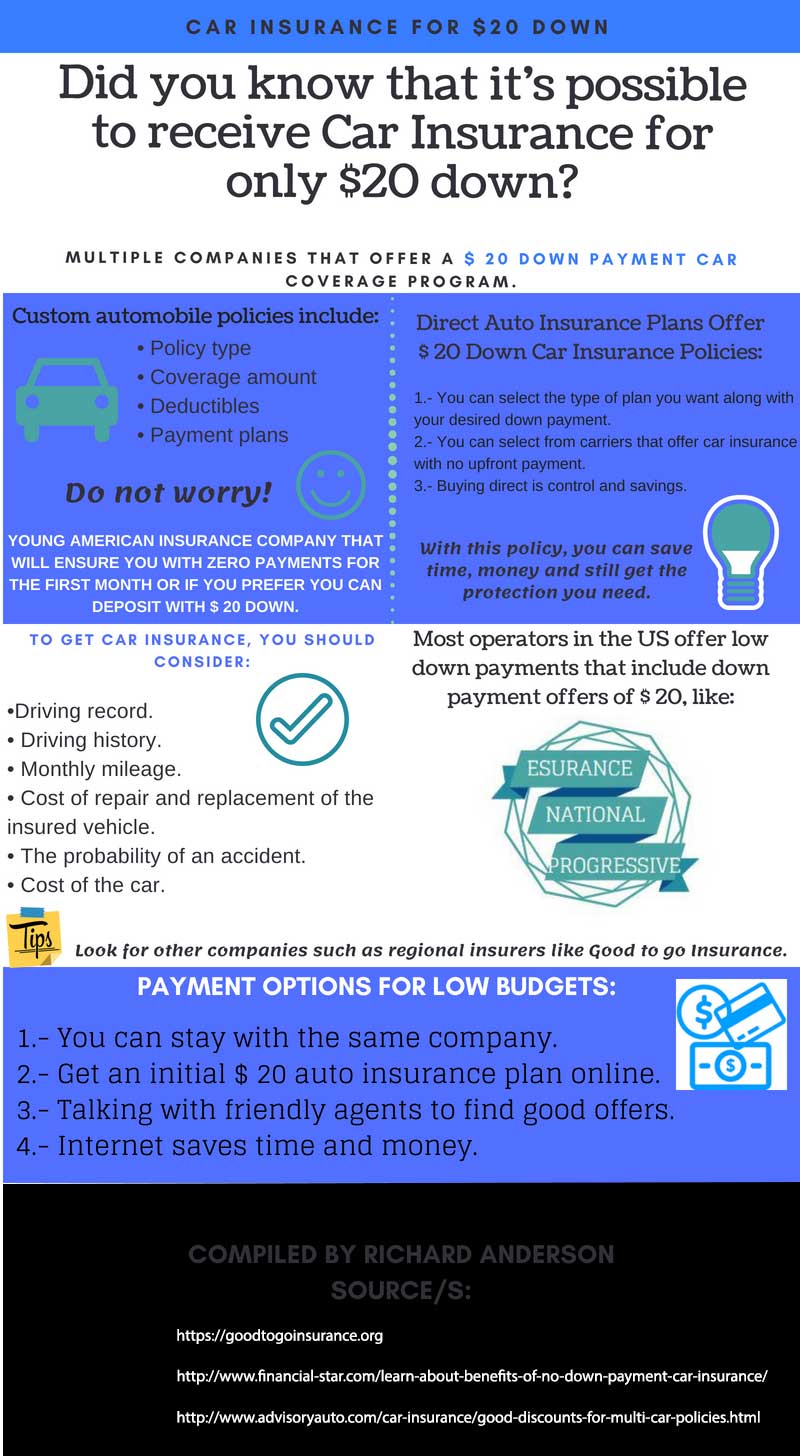

Did you know that getting car insurance is possible by paying a minimal down payment? Multiple companies offer $20 down payment car insurance policies to qualified drivers. Many of these low-deposit plans can be purchased directly through the company website online.

There are also plenty of insurance agents and brokers that can offer assistance in getting $20 down car insurance coverage. This might be a smart option if you are tight on cash and still need to get covered.

You can custom-build an insurance policy that fits your exact needs. One of the most significant benefits of finding good deals online is that you can start putting the pieces together and later compare shops for the best rates. Custom automobile policies include:

With these policies, you can decide your budget, the exact coverage you want, and the payment plan you can afford. Planning can save you money and get you the protection you need.

If you need a $20 down payment auto insurance policy, compare deposit requirements from multiple regional and national providers. Enter your zip code and see what insurers have the lowest down payment options.

One of the many benefits of buying direct is control and savings. You can select the type of plan you want and your desired down payment with direct auto insurance. You can choose from carriers that offer car insurance with no upfront payment.

Many direct providers like Esurance and Progressive have very low deposit auto insurance requirements. Progressive has plans with deposits as low as $20 down. You can use your smartphone to get a direct quote and even get instant auto insurance with no deposit online.

If you are uninsured, you must get covered as quickly as possible. If you don’t have much money to put down, don’t worry. Direct carriers like Young America Insurance Company offer $20 down payment car insurance in addition to no deposit plans for qualified drivers.

With deals like this, there is no excuse not to have auto insurance coverage. Some consumers feel more comfortable putting down a large deposit. This is why some policies offer discounts if you put down a large deposit or pay your premium in full.

Credit plays an increasing role in auto insurance pricing. Consumers with good credit can often get the cheapest auto insurance with no deposit. However, if your credit is not perfect, don’t worry. Several national providers have good deals for those with less-than-perfect credit. This includes auto insurance deposit requirements from just $20 down. You can still qualify for a low down payment plan online if your driving record is not perfect or you are a young driver under 25 years of age.

Read More ...

Getting the best zero down auto insurance plan is essential to getting your needed coverage. It would be best if you stuck with the basics when you want to stay within your budget. First, you must consider the type of insurance to choose from. The basic types include:

Once you choose the type of insurance, you should consider additional options such as uninsured motorist protection, medical cost limits, and gap auto insurance for financed vehicles. Gap coverage can help if you total a vehicle a few months after buying it that’s depreciated more than the balance left on the auto loan.

There is a solution for consumers that can’t afford to make a large deposit payment but still need to get their vehicle insured as soon as possible. The first thing you need to do is look for auto insurance carriers that specialize in $20 down payment auto insurance deals. This is where it gets a little bit tricky. Whether you qualify for low deposit auto insurance will depend on a few things.

The first will be the make, model, year, and type of car you plan on getting insured. Claims for these cars can run into the 6-figures and even higher. These figures aren’t realistic because the insurer knows there is an increased chance of a “high-performance” automobile getting into a wreck and causing severe damage and injuries. For example, you probably can’t call a provider and try to get a Porsche sports car covered with $20 down or even a $100 deposit.

If your vehicle is new and costly, there is less chance you will be able to get a policy with nothing down than a used car worth less than $6,000. However, if you have a used Toyota Corolla that only drives 400 miles per month, you have a shot at a $20 deposit car insurance plan. Remember, when you buy coverage, the provider is taking a risk and betting that you won’t get into a wreck.

This includes calculating many factors of risk, like repair and replacement costs. If you buy a new BMW that costs $60,000, you probably won’t need zero down car insurance. That’s a good thing because it’s unlikely you could find it.

Getting the cheapest car insurance down payment requires being less of a risk to insurers. The less likely you are to get into an accident, the more willing an insurer will offer incentives on the policy. Another factor that comes into play when trying to get a $20 down payment car insurance is credit. These days auto insurance firms are placing a higher degree of weight on a person’s credit rating.

The theory goes that someone responsible for their money will also be a responsible driver. To qualify for a $20 deposit auto insurance policy, you must ensure your credit is in good standing. It would be best if you scored above 650 and, ideally, 700 or more. If it’s not, take aggressive steps to get it fixed as soon as possible. It will help you with cheaper car insurance and so many other things, like a low-interest-rate auto loan.

The type of car you own is a significant factor in how much it costs to get insured. If you own a luxury or sports vehicle such as a Corvette, you likely won’t be able to qualify for a $20 down payment car insurance or a no-money down policy.

Insurers know that if you own an expensive high-performance vehicle, chances are you will, on occasion, take some risks and drive aggressively. High-performance and luxury automobiles are more likely to get into an auto wreck or get stolen. This causes expensive claims, which results in increased premiums and deposit amounts.

If you own a used sports car, there is a chance you can qualify for $20 down payment coverage. You will need excellent credit, a history of continuous coverage, no at-fault accidents, and driving less than 800 miles per month. To check rates for sports cars, enter your zip code and fill out an online application. Check out the low rates at Young America Insurance’s new website.

If you drive less than 600 miles a month and own a used Toyota Camry or similar automobile, you can usually get cheaper premiums. Besides, if you only drive a few hundred miles per month, you are far more likely to qualify for no money down auto insurance. Newer, more exotic, and higher-cost vehicles are harder to insure with zero down auto insurance or even with a $20 down payment car insurance.

When you apply for auto insurance, there are a lot of factors the carrier looks at. This helps them get a solid idea of the risk you pose as a driver and whether or not you qualify for low down payment auto insurance. These include:

If you want the best auto insurance plans for your budget, you need to prove that you are less of a risk to the insurance companies. The less probable it is for you to get into an accident, the more willing the insurer will offer discounts on down payments. This will save you money in the short run and long term.

Unfortunately, credit is a significant factor that plays into your chances of getting low deposit coverage and low monthly payments. Most insurance companies believe that the better the credit score, the more responsible the person is.

So if you want to qualify for a $20 down automobile insurance policy, you will likely need a good credit score above 650. If it isn’t good, you should work hard to improve it as quickly as possible.

The easiest and fastest way to obtain a discounted $20 down payment car insurance deal is to search the web. For example, the Progressive Insurance website offers tons of payment plans between $0 and $40 down for first-time customers. Their site is one of the best for browsing custom plans, including excellent advice on coverage amounts. You can alter or change your plan anytime and make payments directly online.

There are many benefits and drawbacks to $20 down payment auto insurance plans. If you need auto insurance coverage with the lowest deposit requirement, then you need to know what you’re getting yourself into and whether it makes sense over the long run.

For example, you might think you are getting an excellent policy with no down payment required. However, you could end up paying $150 a month for the following year. This comes out to $1,800 per year. It is more expensive than a plan with a higher down payment. For example, a plan that offers car insurance first month free but only $110 a month for the next year will total out to $1,320, which is over $480 cheaper.

Of course, there is no opportunity for wiggle room for some customers. If your budget is tight and you need insurance immediately, the no down payment plan might be the only option. You’re more willing to pay a little more for the following months since you’ve been allowed to pay nothing upfront.

You should consider purchasing liability-only coverage if you need the cheapest possible rates. Remember that it might not fully cover you if you get into a major wreck. The state’s minimum coverage requirements can be as low as $29 per month, which is less than a dollar a day.

Everyone that drives is required to get their vehicle insured. The best way to get covered as quickly as possible when you’re low on cash is to secure a $20 down payment auto insurance plan. Whether it is a more expensive plan, low down payment auto insurance packages are a lifesaver for customers with extremely low cash on hand.

You can renew the same policy with your company over and over again. A lot of insurance carriers will provide renewal incentives to new customers. This is a crucial benefit that you should not overlook. If your insurer raises your premium, you should shop around and get better rates.

A simple way to save on auto insurance is to pay the entire premium upfront. This could be a six or 12-month plan. If you decide to do this, you will get a reduced policy rate. It’s also one less bill you have to worry about each month.

Those who purchase policies that include a $20 down payment car insurance should expect to pay more for the policy. The carrier is taking a risk and insuring you for less than the average market price in hopes you continue to pay each month throughout the policy. The insurer offsets this implied risk with the way of higher rates. You can expect to pay about 3% to 5% more for a $20 deposit car insurance policy than if you paid the entire premium upfront in full.

A few well-known insurance carriers offer auto insurance policies, including instant auto insurance with no down payment. The largest U.S.-based insurers like Esurance, Nationwide, and Progressive offer these kinds of deals. You can also secure coverage online, which makes it fast and convenient.

Even though no money down car insurance doesn’t exist, there’s a chance to secure cheap car insurance with a low down payment with these companies. Before you settle down on an option, you must understand each policy’s pros and cons.

Make sure you do substantial research to understand what you’re investing in before making your final choice. Instead of going with one of the biggest insurers, look for other companies, such as regional insurers like Good to Go Insurance and the big guys like Geico and 21st Century.

Get a Quote now. Start by entering your zip code.

You’re in luck if you feel more comfortable working through an agent rather than looking online. Many friendly agents work for direct insurers that can assist you with obtaining quotes. This includes $20 down payment car insurance deals. They can also help you with any questions you have, which can be helpful. Agents can also help you find discounts you otherwise might not know about.

What insurance customers have found most helpful about direct-to-consumer auto insurance is it saves so much time. You can apply for free quotes through the major insurers just a few minutes from the comfort of your home or car.

The best way to get the cheapest rates and low deposits from $20 down is to comparison shop through the web. Using your phone, you can get quotes from almost anywhere. When speaking to an agent on the phone, you can be on hold for 30 minutes or more without even being able to compare quotes. Get a Quote now by entering your zip code.

The great thing about getting quoted online is that there is no incentive to purchase the coverage right then and there. You have to put in some of your personal information, contact the quote, and then repeat the process for the following insurance company you’re considering.

It’s a good idea to get quotes from up to 10 regional and national insurers. This will help you compare the cheapest auto insurance with low down payments of $20. When you select a company and a price range you like, you can start looking at individual components of the plan and buy the policy when you’re ready.

There are several different types of monthly payment plans available. Various installment programs are available that correlate with your down payment amount. It can amount to zero down when the policy starts or a very low deposit. There are multiple options to choose from. They include:

Choose your payment plan carefully. If you are low on cash, get a policy with the lowest deposit and monthly installment payments. If you find a cheaper rate, you can always switch carriers.

When someone chooses an installment plan to pay for their coverage, they must put down a deposit to start the policy. This often includes the first month’s payment amount. However, there are different ways to pay the bill and various amounts that can be selected. The great benefit of buying a direct policy is that you can also make payments online.

The most common payment methods that you have available include the following:

When researching the cheapest car insurance with no down payments, you must compare the monthly premium payments. Many people don’t have $1,000 or more saved to pay their auto insurance premium upfront. Almost all national providers have this option.

You can even set up direct deposit payments. Funds will automatically be taken out of your bank account each month on the day you choose. If a problem arises, you can cancel anytime. Many insurers even offer a small discount to customers who set up automatic payments.

You can avoid additional fees by using your credit card each month. This will prevent costly fines in the event your account is overdrawn. It’s up to you to decide which payment option you prefer.

When you need auto insurance with the lowest deposit and monthly payments, you must research the best options online. Get as many quotes as possible from leading comparison sites like Young America Insurance. You’ll find the lowest rates and deposits, which start at just $20 down.

To get started, apply online. You can get a full quote in about four minutes. Then, you can compare up to 10 different plans for free and choose the policy you want. Compare $20 down payment car insurance plans and lower your premiums today. You can always learn more about auto insurance at Wikipedia.