Cheap Car Insurance In GA With Low Down Payment

25+ Years of Trusted Service *

Call us 1-855-620-9443

25+ Years of Trusted Service *

Many residents of the Peach State look for smart ways to save money any way they can, including cheap car insurance in GA with low down payment. Getting a low deposit insurance policy in Georgia allows drivers to get legal coverage with minimal out-of-pocket expenses. These types of policies are not offered by all insurers, and not every driver will qualify. They are popular with drivers low on cash who still need to cover their vehicle.

Georgia is a bustling southern state with a diverse population and one of the largest cities in the south, Atlanta. From the booming metro Atlanta area to peanut farmland, Georgia has a proud and rich history. While the Peach State has affordable housing in many cities and cheaper gas than the national average, residents do pay higher than the national average for auto insurance coverage.

Many lower-income residents with minimal savings need low-cost insurance coverage. One solution to getting insured for less is cheap car insurance in GA with low down payment. While this type of policy can cost a bit more, it helps so many drivers that are low on cash get their vehicle covered. Many people don’t have hundreds saved up for a large deposit and need low-deposit auto insurance in Georgia under $50 down. To compare low deposit plans where you live, get a free no-obligation quote. To start, enter your zip code.

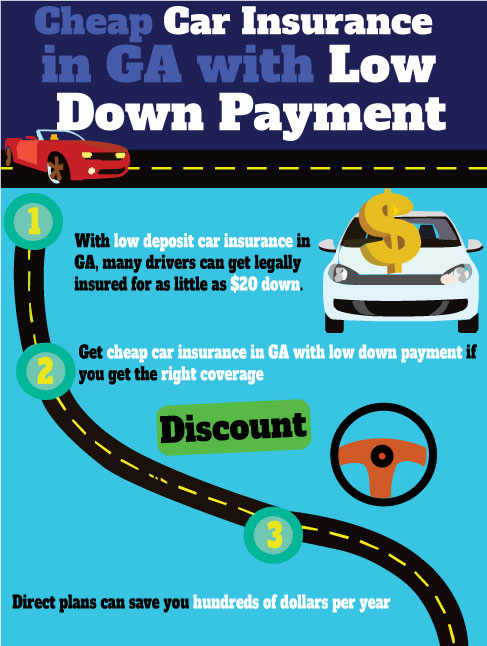

With low deposit car insurance in GA, many drivers can get legally insured for as little as $20 down. These cheap down payment car insurance policies have helped thousands of Georgia residents get legal coverage where they otherwise might have gone without insurance.

The reality is not all drivers will qualify for $20 down payment car insurance in Georgia. Auto insurance companies rate the risk profile of each driver. The higher risk the driver poses, the larger deposit will be required. If someone has a DUI on their record or several reckless driving charges, they might not be able to get insured. To increase your chances of qualifying for low down payment coverage:

Georgia can be an expensive place to live, especially in booming areas like suburban Atlanta. While it is not the most costly state for auto insurance in the U.S., it still has some of the highest car insurance rates in the country.

This is due to several factors, including greater incidents of vehicular theft and fraudulent claims. However, it’s still possible to get cheap car insurance in GA with low down payment if you get the right coverage and compare multiple quotes. The first step is to compare multiple quotes and see what carrier has the lowest rates and deposit requirements.

Each car insurance company in Georgia sets its own unique pricing, and rates can vary a lot between each insurer. Therefore, it’s so important to compare rates from several companies, preferably ten or more.

Auto-Owners insurance company has the cheapest car insurance in GA, according to The Zebra. The average annual rates are $847, which is hundreds less than most other carriers in the state. Auto-Owners Insurance also has low deposit requirements for safe drivers that start at just $40.

Another cheap insurer in the Peach State is Allied Insurance, almost 50% cheaper than the average rates Mercury Insurance charges. Not only does Allied have cheap rates, but low down payment plans from just $30 down.

Other insurers that have cheap car insurance in GA with low down payment requirements include:

Georgia is one of several states that does not follow the no-fault insurance system. GA law requires that you have your car insurance card with you any time you drive. Your insurance company will provide you with this I.D. card. Be aware that the fine for driving without proof of insurance is $150 in GA. Most major insurance companies now allow you to download their app and show proof of insurance right on your cellphone.

Drivers in the state of Georgia can select from several coverage options. They include:

PIP covers your medical expenses and other related costs when you are injured in an automobile accident. You must have a minimum PIP coverage of $15,000 per person in GA. PIP covers:

GA drivers can personalize their Personal Injury Protection (PIP). There are two options to choose from. The first is full or medical PIP, and the second is PIP primary or health primary.

For drivers in GA, we strongly suggest the following:

If you can afford it, also opt for cheap full coverage car insurance in GA with an affordable deductible. Consider taking out underinsured/uninsured motorist coverage. This will cover damages that results from a driver with little to no insurance.

When you purchase cheap car insurance In GA with low down payment, there are several things to consider. First, it’s essential to understand that the law does require some coverage, while others are entirely up to you. Besides, some plans will protect your car, along with ones designed to protect your assets. Some of the most important aspects to consider include the following:

Our licensed direct auto insurance agents are available to discuss your insurance options and budget. Select a car insurance first month free no deposit plan that will fit both your budget and needs while also ensuring you and your family are properly protected.

In GA, your premium is based on several factors, including how likely you are to get into an accident. To determine this, insurers look at how many other drivers have filed claims in your area. If this number is high, your risk of being involved in an accident is also high. In this case, you can expect to buy now pay later car insurance and save.

When you turn 65, you may also notice an increase in your car insurance rates. However, there are no special stipulations for senior drivers. Car insurance premiums are also higher for younger drivers in Georgia.

The number of vehicle thefts in the area can also affect your premium. In 2016, there were 26,361 cases of vehicle theft reported in GA [1]. This was slightly more than in 2015, when 25,690 thefts were reported. However, your rate may be a bit higher if you drive a top 10 most stolen vehicle. For the year 2022, these include:

The number of uninsured drivers in your area can also impact your premium. The more drivers there are without coverage, the more likely your rate is to increase. GA ranks 4th among states regarding the number of drivers estimated to be driving without insurance, at 12.0%.

GA law states you are driving under the influence if your BAC is 0.08% or higher. If you are suspected of DUI, you must submit to a test. This includes breath, blood, and urine testing. If you want, you don’t do the test; you can easily refuse it. However, if you do, you will likely not see your driver’s license for seven months, and it will be suspended.

Suppose you are coming back from a party where you drank quite a lot, and unfortunately, you got a (DUI) driving under the influence charge. You may face the following penalties:

Besides, a DUI conviction results in 9 points on your license, which remains there for ten years. You will face harsher penalties if you get additional DUIs, such as longer jail time and higher fines. According to our research, anyone convicted of a DUI can expect to pay $830 more per year for their car insurance. For repeated DUI offenders, they may not get insured or have to pay rates that are 300% higher just to get covered.

If you are convicted of driving without car insurance or your GA license is suspended due to a DUI or other violations, you must file an SR-22 form. This form provides proof of financial responsibility. A Georgia R-22 must be carried for 36 consecutive months with the MVC. (Usually, this is filed when your driving license suspension has been lifted.) If you are required to keep and show valid auto liability insurance, insurers can electronically file your SR-22 documents with the state.

GA has banned the use of cell phones for all drivers. This includes talking on the phone and sending or receiving texts. For a first offense, you may be fined as much as $50. For repeated offenders, fines may be imposed up to $150.

Garden State drivers may be eligible for multiple discounts that will reduce their premiums. For example:

Getting cheap car insurance in GA with low down payment is easier than you probably think. All you need is any device connected to the internet, and you can compare plans in minutes. Your cell phone is a magic tool that makes comparing car insurance quotes a breeze.

At Young America Insurance Company, you can compare the lowest online rates from top national insurers. Direct plans can save you hundreds of dollars per year. Start your quote now, and see the savings for yourself. Enter your zip code and compare the best Georgia insurance rates for the coverage you need.