State Farm Roadside Assistance costs drivers on average about $30 per year, but certain vehicles might result in slightly higher rates. This makes State Farm Roadside Assistance one of the cheapest plans of any large insurer.

It’s important to note only State Farm policyholders can add roadside assistance to their policy. The highly rated State Farm program is noted for its fast response and overall excellent customer service. This comprehensive guide will walk you through everything you need to know about State Farm Roadside Assistance.

An Overview of State Farm Roadside Assistance

State Farm Roadside Assistance is a service designed to help drivers when they encounter unexpected issues on the road. Whether you’re dealing with a flat tire, an empty gas tank, or a vehicle that won’t start, State Farm’s program aims to provide quick and reliable assistance to get you back on the road.

Key features of the program include:

- 24/7 availability

- Towing services

- Flat tire changes

- Battery jump-starts

- Lockout services

- Fuel delivery

How Much Does State Farm Roadside Assistance Cost?

The cost of State Farm Roadside Assistance can vary depending on several factors, including your location, the type of vehicle you drive, and your existing insurance policy. Generally, there are two main ways to obtain roadside assistance through State Farm:

- As an add-on to your auto insurance policy: Adding roadside assistance to your existing State Farm auto insurance policy is often the most cost-effective option. The exact price can vary, but many customers report paying between $5 and $15 per vehicle, per six-month policy period. This translates to roughly $10 to $30 per year, making it one of the cheapest roadside assistance options from any insurer.

- As a standalone service: For those who don’t have State Farm auto insurance but still want to use their roadside assistance service, there’s a standalone option called “On the Road” coverage. This service typically costs more than the add-on option, with prices ranging from $40 to $80 per year, depending on the level of coverage chosen.

It’s important to note that these are general price ranges, and the actual cost can vary. For the most accurate pricing, you should contact State Farm directly or speak with a local State Farm agent.

State Farm 24-Hour Roadside Assistance

One of the key features of State Farm’s roadside assistance program is its 24/7 availability. This round-the-clock service ensures that help is just a phone call away, regardless of the time of day or night.

- Main Roadside Assistance number: 877-627-5757

- State Farm mobile app: Available for both iOS and Android devices

- Online through the State Farm website

The 877-627-5757 number is the primary contact point for roadside assistance. When you call this number, you’ll be connected with a State Farm representative who will gather information about your situation and dispatch the appropriate help.

Using the mobile app or website can be advantageous as it allows you to input your location digitally, potentially speeding up the process of sending help to your exact location.

Key points about State Farm’s 24-hour service:

- Available 365 days a year, including holidays

- Accessible from anywhere in the United States and Canada

- Staffed by trained professionals who can dispatch appropriate help

- Utilizes a network of service providers to ensure timely assistance

The 24-hour availability is particularly valuable for those who frequently travel long distances or work non-standard hours. It provides peace of mind knowing that help is available at any time, whether you’re commuting to work in the early morning hours or returning from a late-night event.

State Farm Roadside Assistance Towing Miles

Towing is one of the most important services offered by State Farm’s roadside assistance program. The towing policy is as follows:

- For policyholders with the add-on roadside assistance coverage: Towing to the nearest repair facility is covered, regardless of the distance.

- For those with the standalone “On the Road” coverage: Towing is typically limited to a certain number of miles (often around 60 miles), with additional mileage charged at a per-mile rate.

It’s important to note that State Farm’s policy of towing to the nearest repair facility can be both an advantage and a potential drawback:

| Advantage | Potential Drawback |

|---|---|

| If you break down far from home, you won’t have to pay out of pocket for a long-distance tow. | You may not be able to choose your preferred repair shop if it’s not the closest option. |

For those who frequently travel long distances or in rural areas, State Farm’s unlimited towing to the nearest repair facility (for add-on coverage) can be a significant benefit.

State Farm Roadside Assistance for Flat Tires

Flat tires are one of the most common roadside issues, and State Farm’s assistance program includes tire change service. Here’s what you need to know:

- The service includes changing your flat tire with your vehicle’s spare tire.

- If you don’t have a spare tire or if it’s not in usable condition, State Farm will typically arrange for a tow to the nearest repair facility.

- The service is performed by trained professionals who carry the necessary equipment.

- In most cases, there’s no out-of-pocket cost for this service if you have roadside assistance coverage.

It’s important to note that this service is designed for emergency tire changes only. It doesn’t cover the cost of a new tire or any repairs that might be necessary. Regular tire maintenance and keeping your spare tire in good condition are still your responsibility.

State Farm Roadside Assistance Near Me

State Farm’s roadside assistance program operates through a network of local service providers across the United States and Canada. This means that when you call for assistance, State Farm will dispatch the nearest available qualified provider to your location.

Key points about local service:

- Coverage is available throughout the U.S. and Canada

- Service providers are vetted by State Farm for quality and reliability

- The mobile app can use your phone’s GPS to pinpoint your location accurately

To find information about State Farm roadside assistance in your specific area:

- Visit the State Farm website

- Use their “Find an Agent” tool to locate a local State Farm office

- Contact the local office for detailed information about roadside assistance in your area

Remember, even if you’re traveling outside your local area, State Farm’s national network means you can still receive assistance wherever you are in the U.S. or Canada.

Is Roadside Assistance Free with State Farm?

Roadside assistance is not automatically free with State Farm insurance policies. Here’s a quick breakdown:

- For most auto insurance policies, roadside assistance is an optional add-on service that comes with an additional cost.

- The cost is generally quite low (often $5-$15 per six-month policy period per vehicle or $10 to $30 per year) when added to an existing policy.

- Some premium State Farm policies may include roadside assistance as a standard feature. Check your policy details or speak with your agent to confirm.

- If you use the service, there’s typically no additional out-of-pocket cost at the time of service for covered events.

While not free, many customers find the service to be a good value, especially considering the potential costs of individual roadside services if paid for out-of-pocket.

State Farm Roadside Assistance vs AAA

Both State Farm and AAA offer roadside assistance programs, but there are some key differences to consider:

| Category | State Farm | AAA |

|---|---|---|

| Coverage | Typically covers the policyholder and the insured vehicle. | Covers the member as an individual, regardless of which vehicle they’re in (even as a passenger). |

| Cost | Generally cheaper when added to an existing auto policy ($10-$30/year). | More expensive ($60-$120/year for a basic membership), but includes additional benefits. |

| Towing | To the nearest repair facility (unlimited miles for policy add-on). | Offers tiered plans with different towing distances (typically 5-200 miles depending on membership level). |

| Additional Benefits | Focused primarily on roadside services. | Offers a wider range of benefits including travel discounts, maps, and trip planning services. |

| Service Network | Uses a network of local providers. | Has its own fleet of service vehicles in many areas, supplemented by local providers. |

The choice between State Farm and AAA often comes down to individual needs and preferences. State Farm’s service is typically more cost-effective for those who already have State Farm auto insurance and primarily need basic roadside coverage. AAA might be preferable for those who want a more comprehensive set of travel-related benefits or coverage that follows them in any vehicle.

State Farm Roadside Assistance For Dead Batteries

State Farm’s roadside assistance program includes a battery jump-start service. Here’s what you need to know:

- The service provider will attempt to jump-start your vehicle’s battery.

- If a jump-start doesn’t work, they can arrange for towing to the nearest repair facility.

- The service is available 24/7, like all State Farm roadside assistance services.

- There’s typically no out-of-pocket cost for this service if you have roadside assistance coverage.

It’s important to note that this service is for emergency situations and doesn’t include battery replacement. If your battery needs to be replaced, you’ll need to cover that cost separately.

Tips for battery maintenance:

- Have your battery checked regularly, especially before extreme weather seasons.

- Keep battery terminals clean and free of corrosion.

- Avoid leaving lights or accessories on when the engine isn’t running.

- Consider using a battery maintainer for vehicles that aren’t driven regularly.

State Farm Roadside Assistance For Keys Locked in Your Car

Getting locked out of your vehicle can be a stressful experience, but State Farm’s roadside assistance includes lockout services. Here’s what you should know:

- A service provider will be dispatched to your location to help you regain entry to your vehicle.

- This service is available 24/7, like all State Farm roadside assistance services.

- There’s typically no out-of-pocket cost for this service if you have roadside assistance coverage.

Important notes:

- The service provider will require proof of ownership or authorization to access the vehicle.

- For security reasons, they may ask for identification.

- This service is for emergency lockouts only and doesn’t include replacement of lost keys or rekeying services.

- If the lockout cannot be resolved on-site (e.g., for vehicles with advanced security systems), towing to a dealership or locksmith may be necessary.

How to avoid lockouts

- Consider keeping a spare key with a trusted friend or family member.

- Some modern key fobs allow you to program a backup entry code.

- Be cautious about leaving keys in the vehicle, even momentarily.

State Farm Roadside Assistance For RVs

State Farm’s roadside assistance program does extend to RVs, but there are some important considerations:

Coverage:

- RVs can be covered under State Farm’s roadside assistance, but they need to be specifically listed on your policy.

- Coverage is typically available for both motorhomes and towable RVs.

Services:

- Similar to car coverage, services include towing, fuel delivery, battery jump-starts, and lockout assistance.

- However, due to the size and weight of RVs, some limitations may apply.

Towing:

- RVs can be towed to the nearest repair facility.

- Due to the specialized nature of RV towing, wait times may be longer than for standard vehicles.

Cost:

- Adding an RV to your roadside assistance coverage may increase the cost compared to standard vehicle coverage.

- The exact cost can vary based on the type and size of the RV.

Important notes:

- Not all service providers can handle large RVs, which could affect response times.

- Some very large or heavy RVs may require specialized towing services, which could incur additional costs.

- It’s crucial to discuss your specific RV and coverage needs with your State Farm agent to ensure you have appropriate protection.

The Average Wait Time For State Farm Roadside Assistance

The average wait time for State Farm roadside assistance can vary significantly based on several factors:

Typical wait times:

- Urban areas: Often 30-60 minutes

- Suburban areas: Typically 45-90 minutes

- Rural areas: Can be 60-120 minutes or more

Factors affecting wait time:

- Location: Urban areas generally have faster response times due to a higher density of service providers.

- Time of day: Late-night or early-morning calls may have longer wait times.

- Weather conditions: Severe weather can increase demand and slow response times.

- Type of service needed: Some services (like lockouts) may be quicker than others (like towing).

- Current demand: High-volume periods (like holiday weekends) can increase wait times.

State Farm’s system:

- When you call, you’ll typically be given an estimated arrival time for the service provider.

- The mobile app often provides real-time updates on the service provider’s location and ETA.

While State Farm strives to provide quick service, it’s always a good idea to have a backup plan for emergencies, such as keeping emergency supplies in your vehicle and having alternative contact numbers for local towing services.

How State Farm Roadside Assistance Compares to Other Major Insurers

To provide a comprehensive view, let’s compare State Farm’s roadside assistance to programs offered by other major insurers:

| Company | Information |

|---|---|

| Geico |

|

| Progressive |

|

| Allstate |

|

| USAA |

|

| Liberty Mutual |

|

| Farmers Insurance |

|

Key comparisons:

- Cost: State Farm tends to be one of the more affordable options when added to an existing policy.

- Availability: State Farm’s wide network of agents and service providers gives it an edge in many areas.

- Customer Service: State Farm generally receives positive reviews, though experiences can vary.

- Additional Benefits: Some insurers offer extra perks (like trip interruption coverage) that State Farm doesn’t include in its basic roadside package.

When comparing insurers, it’s important to consider not just the roadside assistance program, but the overall value of the insurance policy and the quality of service in your specific area.

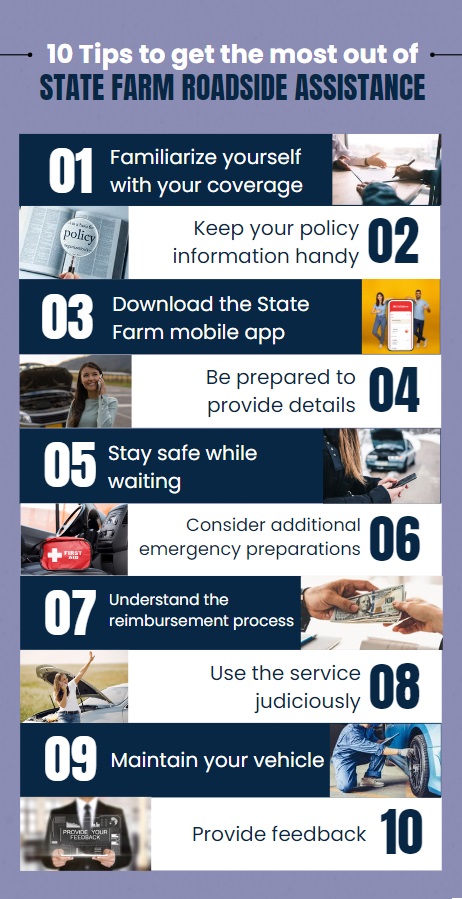

Tips for Using State Farm Roadside Assistance Effectively

To get the most out of your State Farm roadside assistance coverage, consider these tips:

- Familiarize yourself with your coverage: Know exactly what services are included and any limitations.

- Keep your policy information handy: Store your policy number and the roadside assistance number in your phone and in your vehicle.

- Download the State Farm mobile app: This can make it easier to request service and track the arrival of help.

- Be prepared to provide details: Know your vehicle’s make, model, and location to speed up the assistance process.

- Stay safe while waiting: If possible, wait in a safe location away from traffic.

- Consider additional emergency preparations: Keep basic supplies like water, snacks, and a first-aid kit in your vehicle.

- Understand the reimbursement process: If you end up paying out-of-pocket for covered services, know how to submit for reimbursement.

- Use the service judiciously: While there’s typically no limit to the number of times you can use the service, excessive use could potentially impact your insurance rates.

- Maintain your vehicle: Regular maintenance can help prevent many roadside issues.

- Provide feedback: If you have a particularly good or bad experience, let State Farm know. This helps them improve their service.

The Final Word On State Farm Roadside Assistance

State Farm Roadside Assistance offers a comprehensive suite of services designed to provide peace of mind to drivers. With its 24/7 availability, wide range of covered services, and extensive network of service providers, it stands as a competitive option for drivers looking for cheap roadside assistance.

The program’s relatively low cost when added to an existing State Farm auto policy makes it an attractive choice for many drivers. Get your custom auto insurance quote today with roadside assistance priced into the policy, and see how much money you can save.