Average Seattle liability rates, WA minimum limits, and the cheapest insurers to compare in 2025

By: Young Americans Insurance Editorial Team

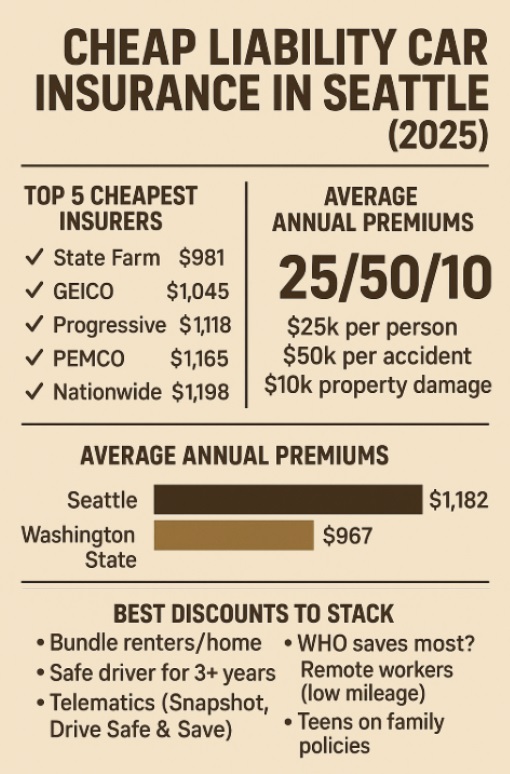

Seattle drivers pay about $2,770 per year (roughly $231 per month) for full coverage auto insurance. If your goal is the lowest monthly bill, many Seattle residents look for cheap liability car insurance—often averaging around $121 per month (about $1,452 per year), depending on the driver and ZIP code.

Your exact rate can change a lot based on your driving history, address, vehicle, and (in Washington) credit-based insurance scoring. With dense traffic from Bellevue through downtown to Ballard—and higher repair costs in the city—it’s common for Seattle premiums to come in above the statewide average.

Washington’s Minimum Liability Requirements

Washington follows an at-fault system, which means the driver who causes a crash is responsible for the other party’s injuries and property damage (up to the limits on the policy). The state’s minimum liability requirement is 25/50/10:

- $25,000 bodily injury per person

- $50,000 bodily injury per accident

- $10,000 property damage

Those limits meet the legal minimum to drive, but in Seattle they can be thin—especially for property damage. With higher vehicle values and higher repair costs, many drivers choose 50/100/50 or 100/300/100 for stronger protection without always doubling the price.

The Five Cheapest Liability Insurers in Seattle

Rates vary by ZIP code, but across much of King County, these five insurers often show up among the lowest-priced options for liability-only coverage. Use them as a starting shortlist, then compare quotes using the same driver details and coverage limits.

| Rank | Company | Avg. Annual | Est. Monthly | Why It’s Often Competitive in Seattle |

|---|---|---|---|---|

| 1 | State Farm | $981 | $82 | Strong multi-policy discounts and steady regional pricing |

| 2 | GEICO | $1,045 | $87 | Efficient pricing for many profiles and easy online quoting |

| 3 | Progressive | $1,118 | $93 | Telematics can reward low-mileage city drivers |

| 4 | PEMCO | $1,165 | $97 | Northwest-focused carrier that often prices WA drivers well |

| 5 | Nationwide | $1,198 | $100 | Competitive for multi-car households and bundled policies |

Local note: PEMCO deserves special mention because it’s Washington-based and often understands regional risk patterns better than some national carriers. Many long-term customers also see loyalty-style pricing advantages over time.

The Overall Cheapest Insurer in 2025

🥇 Best Overall: State Farm

- ⭐ Often the lowest liability pricing across many Seattle ZIP codes

- ⭐ Stable Washington rate behavior vs. big swings

- ⭐ Best fit for clean records, homeowners, and multi-car households

- ⭐ Helpful local-agent support for discounts and policy reviews

Across many Seattle ZIP codes, State Farm frequently ranks as the cheapest liability auto insurance option, especially for drivers with clean records and households that can bundle policies. GEICO and PEMCO can occasionally undercut State Farm for certain single-vehicle profiles, while Progressive may win for drivers who benefit from telematics.

To find the real cheapest price for your situation, the fastest move is to compare quotes from all five carriers using the same coverage limits and details. Rates can shift after new filings, so a company that was “average” last quarter can become the cheapest surprisingly fast.

How to Buy Seattle Liability Auto Insurance and Save

Start by understanding what insurers will “see” when they price you. In Washington, insurance-based credit scoring can matter, so it’s smart to check your credit profile and correct errors. Even small improvements can change your tier and reduce your premium.

Collect at least five quotes using the same coverage limits, vehicles, and drivers each time. Keep mileage consistent too. If you work remotely or ride transit most days, list a lower annual mileage—many drivers see meaningful savings when their mileage drops.

Explore usage-based insurance. Programs like Progressive Snapshot, State Farm Drive Safe & Save, and Nationwide SmartRide can reward cautious driving—especially if you drive fewer miles and avoid late-night trips.

Finally, choose the cheapest payment structure. Paying semi-annually or annually can reduce fees compared with monthly billing. Stack that with autopay and paperless billing when available.

The Power of Securing Discounts

Discounts are where Seattle drivers can make the biggest dent in premiums. One of the strongest savings levers is bundling renters or homeowners insurance with your auto policy—and with Seattle’s high renter population, it’s a common (and practical) way to lower costs.

Safe-driver savings can also add up fast. If you’ve been claim-free for several years, many carriers apply discounts automatically. Telematics programs can add another layer of savings, and smaller perks—paid-in-full, paperless billing, multi-car—often stack on top of the major discounts.

Liability Car Insurance for Teens in Seattle

Seattle teens often face high premiums because insurers price them as higher risk—sometimes two to three times what experienced drivers pay. The most reliable way to control cost is to keep the teen on a family policy so they inherit household discounts. Adding a teen commonly increases a policy by roughly $1,200 to $1,800 per year, but it’s still usually cheaper than a standalone teen policy.

Encourage your teen to pursue a good-student discount (often a 3.0 GPA or equivalent) and complete a state-approved driver education or defensive driving course. Some carriers apply a discount for course completion, and safe habits help reduce future surcharges as your teen builds a clean record.

Car choice matters too. Avoid high-horsepower models and expensive imports. A safe, moderate-value sedan or crossover with modern safety features can keep the base rate lower.

Liability Car Insurance for Seniors in Seattle

Senior drivers often benefit from experience and lower mileage, but rates can rise gradually later in life. To offset that, focus on discounts and mileage-based pricing.

A mature-driver course may qualify you for a discount with some insurers. Also, if you drive fewer than about 7,000 miles per year, tell your carrier—low mileage can reduce your risk tier. Vehicles with modern safety tech (blind-spot monitoring, forward collision alerts, automatic braking) can also help.

Most importantly, review your policy once a year. Seniors who bundle and pay in full often keep liability premiums well below the city average.

FAQs: Cheap Liability Car Insurance in Seattle

Q. What’s the legal minimum to drive in Washington?

A: Washington’s minimum is 25/50/10 liability coverage: $25,000 per person, $50,000 per accident, and $10,000 property damage.

Q. Does Washington require uninsured motorist coverage?

A: It’s optional, but many insurers include it unless you reject it in writing. It’s often recommended because uninsured driving can still be an issue.

Q. Why are Seattle’s rates higher than the rest of Washington?

A: Dense traffic, higher repair costs, and higher claim frequency in urban neighborhoods tend to push premiums up.

Q. Who’s the cheapest insurer in Seattle right now?

A: Many Seattle ZIP codes trend cheapest with State Farm, with GEICO and PEMCO often close behind. Progressive and Nationwide are also frequently competitive depending on the driver profile.

Q. Is minimum coverage enough?

A: It keeps you legal, but it may not cover severe injuries or expensive property damage. Many drivers choose 50/100/50 for better protection.

Q. Do telematics programs really work?

A: They can—especially if you drive fewer miles, avoid hard braking, and don’t drive late at night often. For the right driver, usage-based pricing can lower premiums.

The Final Word On Cheap Liability Car Insurance in Seattle

Seattle’s roads can be expensive to insure, but cheap liability coverage is achievable if you shop strategically. Start by quoting State Farm, GEICO, PEMCO, Progressive, and Nationwide on the same day using the same limits.

Aim for at least 50/100/50 if your budget allows, then stack discounts like bundling, telematics, paid-in-full, and paperless billing.

Re-shop once per year, keep a clean record, and avoid coverage lapses. Get quoted in minutes and see how much you can save on cheap liability car insurance in Seattle.