Very Cheap “No Deposit” Car Insurance in Texas: What’s Real (and What’s Not) in 2026

Finding very cheap car insurance with no deposit in Texas is one of the toughest challenges for drivers on a tight budget. Many people aren’t trying to “game the system” — they simply need legal coverage with the smallest possible upfront payment.

Ads that promise “$0 down” sound great, but most insurers still require at least some payment before coverage starts (often the first month’s premium). The good news: in Texas, there are providers and payment models — like pay-by-the-day plans or financed start-up payments — that can reduce the upfront cost dramatically.

What “No Deposit” Auto Insurance Really Means in Texas

In car insurance, the “deposit” (or down payment) is the amount you pay at the start of a policy. In many cases, it’s similar to the first month’s premium — but it can be higher if your driving history, prior lapse, or other risk factors increase the insurer’s required starting payment.

Texas law requires every driver to maintain minimum liability insurance. So even when a provider advertises “no down,” the cost is typically shifted into installments or a short-term pay schedule. The key is confirming (1) what you pay today, (2) what you owe next, and (3) whether there are installment or service fees.

Texas Minimum Coverage Requirements

To drive legally in Texas, most drivers carry at least 30/60/25 liability coverage:

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $25,000 property damage liability per accident

If you’re financing or leasing a vehicle, your lender will usually require full coverage (liability + comprehensive + collision). That almost always increases both the monthly bill and the upfront amount.

Average Car Insurance Costs in Texas

Knowing the statewide ballpark helps you spot a deal that’s actually “cheap.” Because prices change constantly by ZIP code and driver profile, it’s safest to use ranges instead of one exact number:

| Coverage Type | Typical Annual Range | Typical Monthly Range |

|---|---|---|

| Full Coverage | ~$2,500–$3,100 | ~$210–$260 |

| Minimum Liability (30/60/25) | ~$750–$950 | ~$60–$80 |

If you can land below these ranges and keep the upfront payment low, that’s usually a better-than-typical outcome — especially if you’ve had a lapse, tickets, or need coverage fast.

What You Can Expect to Pay Upfront

Even with “no deposit” advertising, most drivers should plan for one of these setups:

- Traditional billing: you pay the first month (or a larger initial installment) before coverage starts.

- Split-pay start: you pay a smaller amount today, then a second payment within 7–30 days.

- Micro-pay policies: you pay by the day/week (helpful for low-mileage drivers; can cost more if kept active nonstop).

- Financed start payment: a third party covers the initial insurer payment and you repay it over time (watch terms and fees).

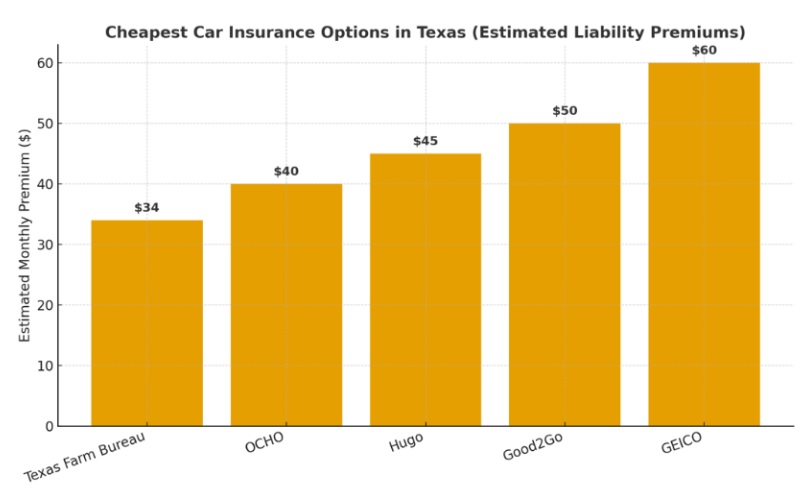

Five Providers/Models That Can Lower Upfront Cost in Texas

These options are popular for low upfront payments. Availability and pricing depend heavily on ZIP code, driving record, vehicle, and whether you’ve had a recent coverage lapse.

- OCHO – Often promotes low-today structures by spreading start-up costs into payments. Best for drivers who need proof of insurance quickly and want a smaller “today” amount.

- Hugo Insurance – Known for pay-by-the-day or pay-by-the-week options. Good for low-mileage drivers or people who want tighter control over payment timing.

- Good2Go Auto Insurance – Frequently markets low down payments and fast proof of insurance. Useful for minimum coverage shoppers, but compare fees and renewal pricing.

- GEICO – A mainstream baseline quote in Texas. Upfront requirements vary, but it’s useful to compare against non-standard options.

- Texas Farm Bureau – Often competitive on price for many drivers, but typically requires membership. Even when the first payment is due upfront, a lower monthly premium can keep that first bill more manageable.

The “Cheapest” Option Depends on Your Goal

- If your goal is the lowest total cost: prioritize strong base rates, clean-record discounts, and stable renewals (fees matter less when the premium is solid).

- If your goal is the lowest upfront payment: prioritize micro-pay plans or split/financed start payments — but always check the first 30-day total and any service fees.

Teen Drivers in Texas

Teens are expensive to insure almost everywhere, and Texas is no exception. “No deposit” structures may reduce the upfront amount, but the monthly cost can still be high due to risk.

| Age | Coverage | What’s Typical |

|---|---|---|

| 16–17 | Liability Only | Often very high; varies sharply by household, location, and vehicle |

| 16–17 | Full Coverage | Usually higher than liability; financed cars push costs up further |

Best cost-control moves for parents: add the teen to a family policy, shop multiple carriers, use good-student discounts, complete driver training, and choose a modest vehicle with strong safety ratings.

How Seniors in Texas Can Cut Their Rates

Many seniors pay less than younger drivers when they have clean records and low mileage. Savings are still possible through:

- Low-mileage programs (if you drive less in retirement)

- Defensive driving courses (where insurers recognize them)

- Bundling auto + home/renters

- Shopping every renewal (pricing changes fast)

Top Discounts That Reduce Both Premiums and Upfront Cost

Lower monthly premiums usually mean a smaller “start” payment too. Stack what you qualify for:

- Good student (teens/young drivers)

- Bundling (auto + renters/home)

- Safe/defensive driving courses

- Low-mileage

- Vehicle safety features

- Paperless + autopay

- Multi-car

- Continuous coverage (avoid lapses)

- Affinity discounts (military, employer, alumni groups)

- Telematics / usage-based programs (if you drive smoothly)

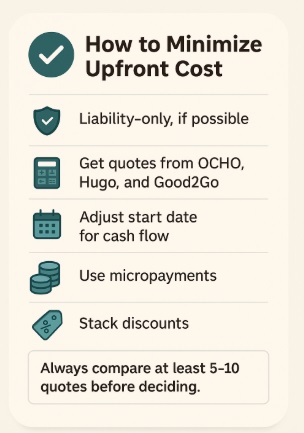

How to Minimize Upfront Cost in Texas (Step-by-Step)

If your goal is to pay as little as possible upfront, focus on the steps that move the needle most. First, decide whether liability-only makes sense for your vehicle (it’s almost always cheaper upfront than full coverage). Second, quote providers that specifically offer low-start payment structures (split-pay, micro-pay, or financed start payments). Third, compare apples-to-apples: same drivers, same address, same limits, same effective date. Fourth, ask about installment fees and the total due in the first 30 days. Finally, lock in every discount you qualify for, because smaller monthly payments usually mean smaller start payments too.

Frequently Asked Questions

Is zero-down car insurance really available in Texas?

Sometimes, but usually with conditions. Many “$0 down” offers work by splitting or financing the start-up payment. Always confirm what you owe in the first 30 days.

Will a no-deposit plan cost more overall?

It can. Some plans add installment/service fees or slightly higher monthly payments. For many drivers, the tradeoff is worth it if it keeps the upfront payment affordable.

What’s the minimum required coverage in Texas?

Texas minimum liability is 30/60/25: $30,000 per injured person, $60,000 per accident for bodily injury, and $25,000 for property damage.

Can I get low-upfront coverage with tickets or accidents?

It’s harder. High-risk drivers often face higher required start payments, but some non-standard providers may still offer split-pay or micro-pay options.

What’s the fastest way to avoid overpaying?

Compare multiple quotes for the same coverage limits and effective date, ask for the total due in the first 30 days, and avoid coverage lapses (they often trigger higher prices).

The Final Word on Very Cheap No-Deposit Car Insurance in Texas

If your priority is the smallest upfront payment, look for split-pay, micro-pay, or financed start-payment options — and always verify the total due in the first 30 days. If your priority is the lowest overall cost, focus on strong base rates, clean discounts, and stable renewals (and be cautious with fees that can quietly raise the total).

Either way, the winning strategy is the same: stay continuously insured, compare apples-to-apples quotes, and stack every discount you qualify for. Comparison shop up to ten quotes in less than five minutes and find very cheap car insurance in Texas with a low upfront payment.

Note: This guide is general information. Prices and eligibility vary by driver and location—confirm details with your insurer and review Texas auto insurance requirements through official state resources.